A month off, a milestone hit.

I should take some time off more often it seems as I am happy to report that we've officially hit another investing milestone. (For all the new people, we take out a small percentage of money to reward ourselves every time we hit the next milestone)

This one has taken its sweet time as we all suffered through a bumpy road, aka a global virus ensnaring the world and driving many economies to the edge... So yea there was that :D

It was the first time in four years that I missed a Firelife post-

Well, we're back! This month's post will be a general life update as well as looking at some interesting things that have happened in the world of investing.

Life Update

We've actually been doing great! HOWEVER, my wife and I have accidentally been running a money experiment on ourselves in the form of a credit card. I can hear everyone gasp. Why the hell does this dude who always preaches about frugality have a credit card? In my work, I often see clients and at my previous company, I would need to pay for things like coffee or lunch. So I wanted something that was separate from our personal finances but my job required me to get my own card.

Here comes the interesting part. In the few years we've had the credit card, I saw our money-spending habits change. It went from we only have x budgeted for entertainment for the month, to "let us just put this one on the credit card, we can pay it off next month."

It felt like someone jerked me from a coma when we both looked and realised how bad it had become. The credit card was supposed to be used for work expenses only and not personal, however, it became such an easy crutch that we leaned on very heavily. I am very scared to look at how much we managed to invest in the past few months... I know it's not nearly enough.

Saving Grace

The one thing that has been happening in the background is the S&P 500 has been killing it and so our overall portfolio was still growing (magic of your money working for you)

So even though we've been doing a rather bad job at investing, at least for the past few months, we are very fortunate in that our portfolio has recently tricked over another milestone.

As fun, as buying very expensive Uber Eats is, we have made a very conscious decision to get back on track. In my new role, the credit card is no longer required so at the end of the month we will be "burning the boats" or in our case, burning the plastic...

The credit card has got to go! Learn from this, people! Everyone and I mean everyone can so easily make this mistake. We are creatures of comfort and convenience. I will report back toward the end of the year as I do my recap and portfolio update to tell you how we went without that terrible piece of plastic convenience!

Getting introspective

In the last few months, I've found myself really looking toward material things. I wanted a larger home, a better car, a better PC etc. In these moments I love to reference one of my favorite YouTubers Ali Abdaal. He talks about if you were to practically look at your life, if you had all the money in the world would it be that much different?

The answer is almost always no. I might have an extra few rooms, a nicer way to get from A to B but it would not actually be meaningful. See at the core of this is the real issue. We want things but do we know why? Do we actually want these things? Often I've found that after I've purchased something, it really was an underwhelming experience.

I'm not saying don't get nice things, I am just saying be honest. These things we crave so much for, are they actually adding to our lives? Or are they adding to an idea that we think we might want? To impress who?

Super pumped to be writing this, excited I can keep sharing the good message of financial independence as I show you how we do it every month!

Cool Things

📚B00ks I read

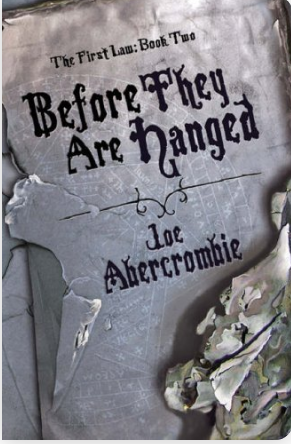

Before they are hanged is the second in the trilogy by Joe Abercrombie and its a certified banger! As a young writer myself, I am trying to read more fiction. These novels are so well written and they put you inside the head of the characters!

Joe makes you love this rag-tag bunch of people as they traverse the land. If you love grimdark novels, this is definitely a must-read.

Are the supermarkets a monopoly?

I read this interesting article about Foodstuffs and a few other big brands who own a very large majority of the supermarkets here in New Zealand. You can read the article here.

Like with many things in life, the answer isn't always a blanket statement. I spoke to a few people who work closely in that industry and they say that fault might not be with the supermarkets but with the overall food distributors. I can't comment on any of this, but I do know that many Kiwis are feeling the pinch! The pinch also means less investing money which makes me very sad!

Thats all!

Thanks for another episode and appreciate you reading as always. Please so fire me any questions if I can help you with anything.

Chat soon!