It's that time of year again - Portfolio update

We are back at it again with another update for you fine folks. I wanted to share how we are tracking against our fire journey as well as discuss a few other things. You might realise that it has been longer than a quarter since the last update for those keeping tabs.

Well firstly, who does that? That is super nerdy so please stop. Then yes you are correct. I wanted to show you guys the wonderful growth and show you how well things are going. Well, the markets are not playing ball so I have decided I will do the update twice a year from now on. Once at the start of the year and then once at the end. I am doing this one to give us a starting point!

Alright into the meat and potatoes we go.

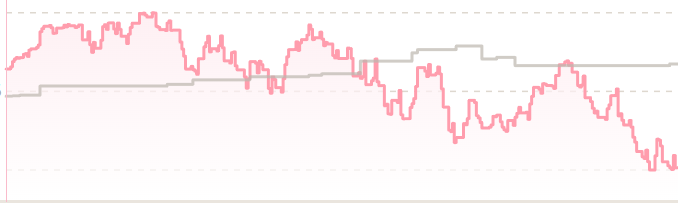

📉Markets - Year to date

It has been a tough time and we can definitely see that the markets have caught up with the tomato prices and things aren’t looking great. Well, it clearly shows.

Our portfolio - YTD

S&P 500 - YTD

Again like I said a grim affair! However as I always harp on, you only lose when you sell. Right now you should be licking your lips at the opportunity to buy things at a discount. For us boring investors that don’t need the money, the opportunity is great.

The blog is a great way to show you that even through all of the crazy things that have happened in the past few years, it is important to stay the course knuckle down and believe in what you are doing.

🔥Our FIRE update

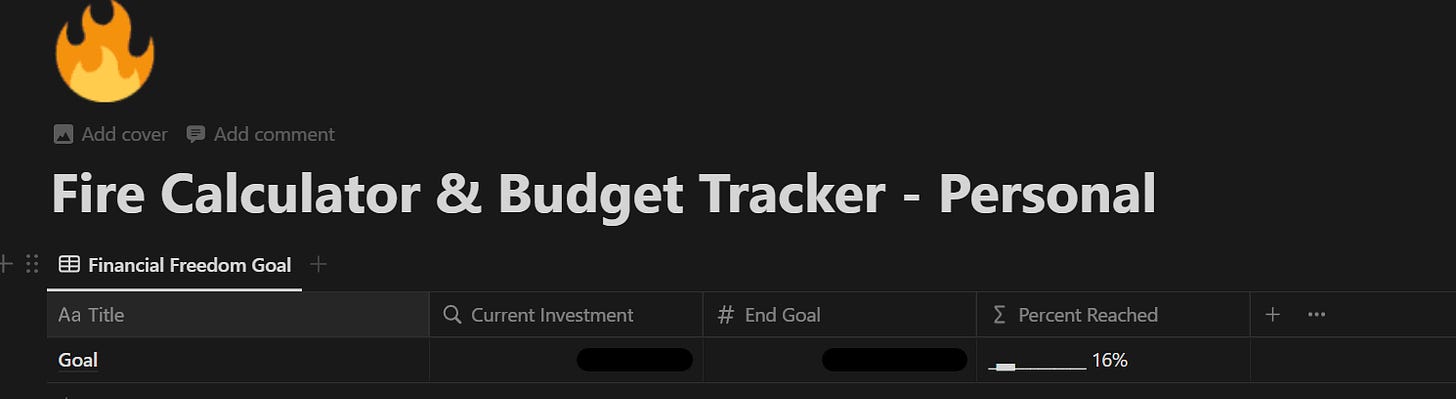

As you may or may not know, I’ve created an online FIRE calculator and budget tracker. (Shameless plug)

And unlike many products out there, I am actually using what I’ve built…

One thing we’ve been struggling to dial in is the exact amount of money we need to be FIRE (financially independent and retire early) We’ve landed on something initially and as it stands, this is how far we are to reaching FIRE.

It is quite interesting when you put in the amounts to see how far we’ve come. Having started on $0 I am quite proud of us as a family. Every cent we have in there has been earnt through sweat and sometimes tears.

This might change as the years go on but for now, we are well on track and I am very happy with our overall progress.

🌱Enough about us

I’ve been following Ruth from The Happy Saver quite closely since I started writing the blog. She is truly a Kiwi gem and she has been doing this for many years.

She was recently featured on another podcast Cooking the books. It was actually featured in an NZHerald article. Ruth’s story had me thinking quite deeply about what our number is. She and her hubby are doing what we like to refer ‘work optional’.

They work on projects and things that make them money etc, however, their main expenses are for the most part covered.

One thing she mentioned was that the majority of their wealth is caught up like many Kiwis in their property. She talks about how her wealth is essentially trapped there and unless you want to leverage against it (Buy another home) it is a pointless asset.

Now I know Ruth and I are on the same page because that is exactly the same way I view properties. Unless they become an investment or they are a long-term plan thing you are happy to sit on, you should really think about whether or not to jump on the ladder.

They talk about how becoming financially independent is quite an interesting thing in the sense that it is something you need to constantly monitor and keep tabs on. t was such an inspiring listen.

Ruth is great and she really has helped Kiwis and people across the world by showing us how it is done.

💰More about you

You are either a spectator or a player. What I mean by this is that you are either currently actively working toward your financial goals and freedom or you are sitting on the sidelines looking in at the game.

You can’t score runs, try goals etc by sitting on the sideline. I want to encourage you today to get going and to keep listening to inspiring people like Ruth who have walked the walk.

More importantly, you need to get going. Stop thinking about doing it and get going.

A great place to start would be my completely free resource for someone who is completely new to stocks. - FREE workbook resource

I would also love to hear from you either in the comment section or via email at mail@firelife.co.nz

Interesting things

Podcast

Check out the Podcast featuring Ruth - Here

Book Update

Chapter 8 has been completed. I am very happy with the progress but I am struggling to sit down and write. It is all my fault as I’ve started playing a video game again… If you know me I really love them and so it has been quite the distraction.

If you wanted to keep up with the book and you are into Sci Fi/Fantasy you can sign up - Here

Next time

I am going to review all of the various platforms and look at their current fees etc. There are a few new players in the market and I am going to review what they can bring to the market and to us the investors.

In the meantime, the team over at MoneyHub have has done an awesome job at breaking it down from their end, so make sure to check out the article they’ve published! - Here