Whats the plan after 'retirement'?

September or my birthday month has rolled around. With it I have been pondering. What will I do when I reach FI financial independence. ‘Wow how great it must to have all the time in the world…’ Is it though?

What will you do with your new found freedom? Thats right, once you are completely financially independent what will you do? The problem I had or still sort of have is this.

Road to FI

This blog has covered a wide array of topics when it comes to financial independence, money, investing for children etc. The road can be a shaky and uncertain one. This road is something I believe all of us should go down.

Being financially independent or reaching early retirement is such a noble pursuit. The reward for putting in the time, investing your money and working hard is worth it. Having complete autonomy over your time is something very few people will ever have.

I recently shared my thoughts and ways of living with a colleague. She started soaking up every piece of FI knowledge and blog known to man. I said enthusiastically ‘once you open up the FI door, you can’t close it’.

I find that to be true with more and more people. People are looking for a different way to live. A way where they can see themselves in their dream home. Waking up anytime they want and being able to be 100% creative. Not having to be in back to back meetings when everything could have been said in a single email.

See this is why having a plan for after retirement is so crucial. You will be saving and working so hard on the road to FI. Its important to know why you are doing this. If not you will slip right back in to bad habits.

Robert Kiyosaki famously disconnected himself from everything for 6+ months just to get out of the day to day hustle of the rat race. The insatiable hunger to always be busy.

This is where he was able to be bored, be free of time constraints and this is where he famously wrote the blueprint for his board game Cashflow.

His book Rich Dad Poor Dad was one of the first books that put me on the path to FIRE (Great read)

Don’t be addicted to money. Work to learn, don’t work for money. Work for knowledge

Robert Kiyosaki

Life after FI

Lets say we are there. Lets dream a little. Lets say money is no issue. We’ve made it, we have arrived. What now? Whats the plan Jack (Whos Jack?)

See this might be a bit trickier than what it first seems. See most people are being told what to do. Most people are comfortable with that. Thats right you heard me. Most people are complacent with the day to day living. People live for the weekend and mentally block out the rest of the week.

Lets say though we’ve made it. We have all the money that we need to live. What on earth will I do on a Tuesday at 10 AM? This was the main questions I’ve been asking myself the last couple of weeks. So I thought I would make a blog post about it (naturally).

See I was thinking I would become a full time video game streamer. Well I might still do that, however I realized I might get bored. So I thought to myself aside from spending time with my wife and daughter, what would I do? What would I want to learn to do? The answer right now is I will be a cricket bat creator. Thats right, I want to create and repair hand made cricket bats. I can hear your falling asleep right now. Hey this is my dream so let me dream it!

See I think thats the beauty of FIRE. The answer doesn’t need to be one or the other. It can be both, or neither. I can choose! I will say that looking forward to doing things that you love or want to learn has really helped us stay on track.

Being able to explore, create, volunteer or be creative is truly free.

Things worth considering on the road to FI

Becoming FI is genuinely an amazing achievement and I can’t wait until we achieve it for ourselves. This however is always going to be slightly different for everyone.

One of my best friends has decided to invest all of his money in bonds until they have 20% down payment on a house. They will be attacking the rest of the mortgage and likely get it paid of in under 10 years. Is this wrong? No.

Just because what they are doing is slightly different to what we are doing does not make it wrong. I’ve learnt a lesson over the last couple of years doing this. Each and every person and their journey will be slightly different, and that is ok. As long as they are on the road to FI they are on the right road.

That being said you should consider what would be the best vehicle to get you there? What would best suit you and your situation? Are you perhaps a builder or a carpenter and you are able to flip homes? Has your father invested in business before?

The point I am trying to make is, the FI road can be scary so you need to use any and every advantage you come across. We for example can live in a studio apartment next to my in laws and get a great rate on rent. Yes we are sacrificing space, however we are paying next to nothing every week to live here. Find what advantage you have and USE IT.

That is why having a plan before you start is even more important than a plan for afterward.

That being said, I am realizing more and more that as I mentioned above, if you don’t have a plan on what to do you with your time after you reach financial independence or you might find yourself back in the cubicle.

Please understand me. As a human we are hardwired to be active and do something, sitting and watching Netflix all day isn’t doing something. This freedom can easily become a burden if you don’t have a plan. I am lucky enough to be doing it with a couple of friends so aside from learning how to create cricket bats, I will be spending a lot of time with them.

‘Finding yourself’

I put the above heading in quotation marks because it has been overused and can be labelled as very spiritual. I truly do believe though that when we are in a place where we aren’t constrained by time, we find out who we are.

you are faced with the good the bad and the ugly. You are free to explore, free to find out who you are. Planning after retirement is one of the most exciting things I am starting to do. It also made me realize that I think I will enjoy working with my hands because I am working on a passion of mine. (I am not good at working with my hands)

Having a plan after retirement will be a reality check. I would challenge you to give it a go. In tandem with my ‘after retirement’ plan I have been making a bucket list. Some of the things on my list :

- Watch the Ashes cricket live with my father

- Watch a boxing title bout

- Go and attend a gaming major tournament

- Create and fix my own cricket bats

- Maybe create a boardgame?

Hope this post has been inspiring and it helps someone.

Our Portfolio

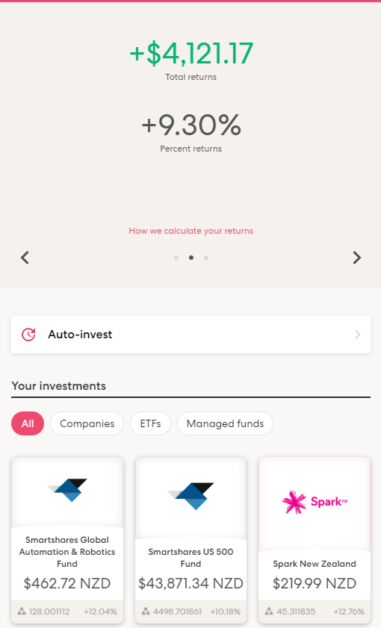

So our portfolio has slightly changed, I sold off my Australian resources fund as well as my Asia Pacific fund.

I only have a very small amount left in Global and automation fund. The rest is in the US500 fund (Just a way for Kiwi’s to invest in the S&P 500)

I genuinely believe we will be getting to FI with more than 90% of our portfolio in this fund. It won’t change.

The fact that we are in the green is pretty sweet as well!

Another in the books. As always, please send me an email down below so I can help you out.

Stay safe.

MK