Why money is not wealth

We made it into another month! How are your investments going? Mine personally is not in the hottest spot with the war still raging on. I had an intriguing thought in the fact that I am hopefully able to point back to these trying times and tell both my kids and grandkids that we went through some very tough times and we made it through.

On a much lighter note, for all my newsletter readers, I will be sending you our portfolio update later in the month, so stay tuned for that. It will be a really valuable insight for new investors in a downturn market.

So for today's post - Let's take a look at why money is not wealth. I am often surprised by the way most people view money in both its creation as well as its accumulation. Money is not wealth in my mind until it becomes an income-generating investment. Let's take a deeper dive into that.

Money & Saving

As I said, I am often quite taken aback by the way that a lot of people approach money. They chase the elusive income dragon by climbing the corporate ladder and making more and more money while holding less and less. Cue mid-life crisis and impulse buy.

I recently had a very interesting conversation with someone I am very close to. They told me about someone they knew who had just received a rather large contract in their business The contract would mean they have work for the next five years, and it would be quite significant. This person who for obvious reasons will not be named then immediately took out a large lease and bought this beauty

"But Milan it's their money and they can spend it any way they like." Yes, you are correct, however I can't sit back, hear this and think this was wise. I am all for people having more than enough. I know literally nothing about cars, but when I heard about the new e-Tron range even my jaw dropped.

The key is this person is leasing this car at around $750 per week on the fact that they unlocked a large business contract.

What is wealth?

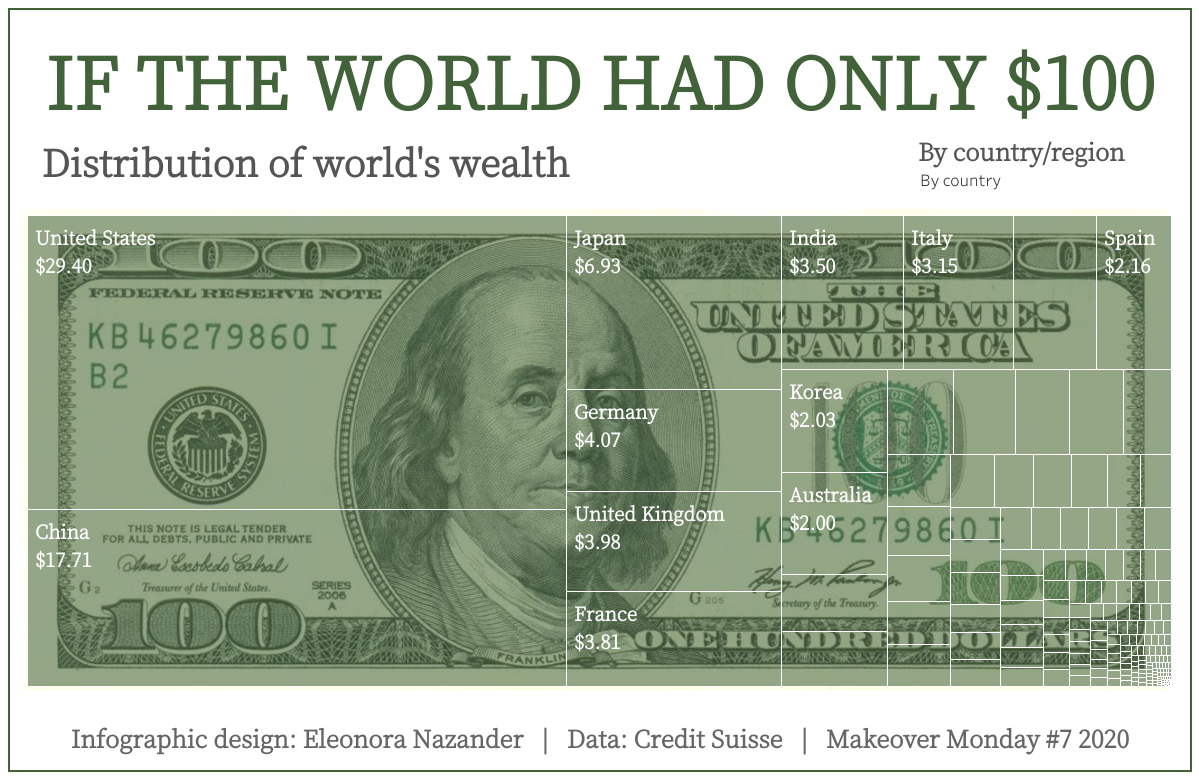

I take a slightly different view when it comes to wealth. Wealth if we looked at it in the traditional sense would look something like the graphic below.

All Americans are rich! Well not quite. That is also why I do not think that this is a good way to look at it.

Wealth = Money that you keep that can make you money.

The main reason I don't count pure savings as wealth is that if you were alive in the past few years, you would have seen your savings be depleted anywhere from 5% - to 10% if it just sat in your account. So having money decay because of high inflation does not count as wealth.

It is something like stocks, homes or any investment that has the potential of making you more money. If the person above bought this car or even leased it with the income they generated from investments. Well, I wouldn't be sitting with my forehead in my palms, I would say. "Wow that car is cool and I wish I had one."

To be honest, I am still saying that...

Where people fall short

I think the main confusion is people's overall approach to money. Most people focus on making more money vs what they keep. The first time this clicked for me was when I read The Richest Man In Babylon.

It was so simple, yet so many people are struggling. The book tells a delightful story and provides such a simple solution to building wealth. Put away 10% as soon as you are paid. So that 10% can work hard for you and make you more money.

I recently watched a video where MrBeast gave someone a million dollars for winning a contest. The videos were super entertaining. Mr Beast then spent a day with the gentleman who won the million dollars and he helped him spend a million dollars in a day.

He goes on to spend a huge amount of money on electronics, Iphones, cars etc. Super entertaining. The video is super unique and a good watch.

Like an old angry uncle, I am here to tell you that I was right! They manage to spend the entire million in a day, however, the key point I am trying to address is that he did think about investing. Good on the young man! Well sort of. He takes $50,000 and sets it aside for investment.

As it turns out he had to pay Chandler, one of the hosts as his coach and somebody else. He also set aside $340k for taxes. So he was left with $510,000

Let's imagine, instead of spending another cent, he invested everything, with the 4% rule he could take out $20,000 every single year for the rest of his life. If he left that same amount for 10 years, without ever adding another cent at 7% returns, he would double his money and have $1,003,247.19

A healthy way of looking at money

I am more than happy for this young man and his winnings. He shared a lot of the things he bought with his family and he also bought a house. All I am trying to point out is that if he had the knowledge and foresight to invest, he would potentially never have to work again in a few years.

The way I think is to view money as a means to an end. A tool to get you to the ultimate goal of financial independence. A life where you truly get your time back.

So ditch the $750 per week lease payments (I am still not over it) and start building wealth that enables you to live a life of freedom!

That's going to do it, folks!

All the best

MK